Welcome to The TSD Elevate

Book a Free Consultation

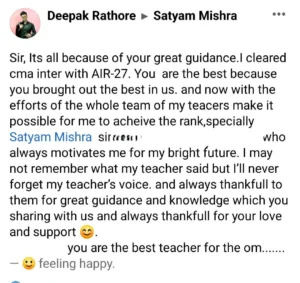

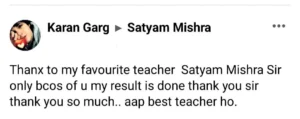

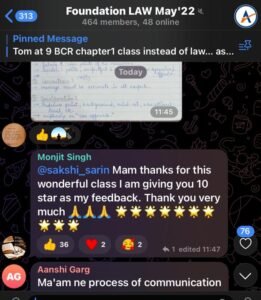

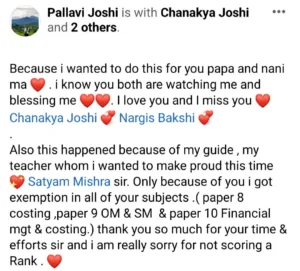

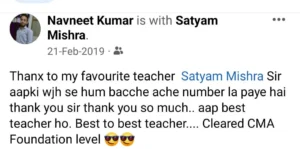

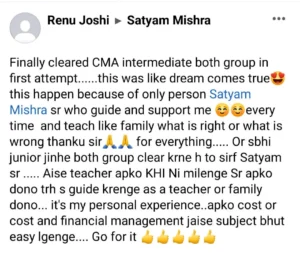

Our Success Stories

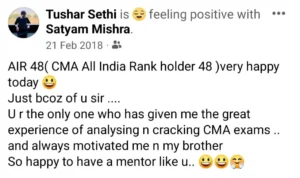

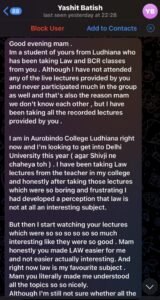

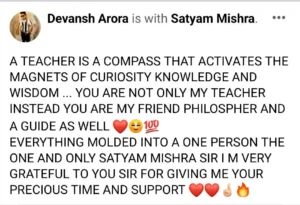

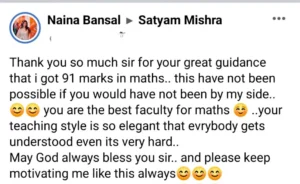

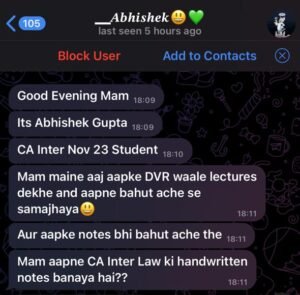

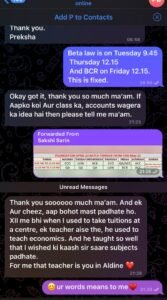

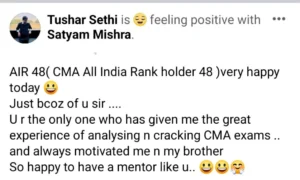

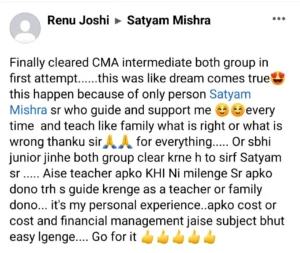

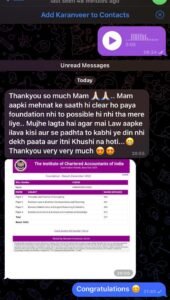

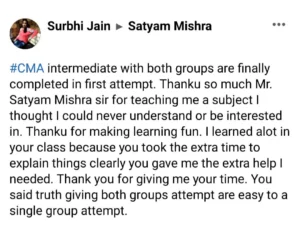

Students Review on Social Media

CMA Intermediate Subjects

TSD Elevate distinguishes itself as the pinnacle of excellence in CMA coaching in Laxmi Nagar Delhi, providing modern classrooms and conducive learning environments.

Education at TSD Elevate is fostered through the following features:

Group - |

Paper 6: FINANCIAL ACCOUNTING (FA)

Section A: Accounting Fundamentals - 25 Marks

Topics

- Introduction to Law and Legal System in India

Indian Contracts Act, 1872

Sale of Goods Act, 1930

Negotiable Instruments Act, 1881

Indian Partnership Act, 1932

Limited Liability Partnership Act, 2008

Section B: Preparation of Financial Statements - 40 Marks

Topics

Preparation of Final Accounts of Profit-Oriented Organizations, Non-Profit Organizations, and from Incomplete Records

- Partnership Accounts

Section C: Self-Balancing Ledgers, Royalties, Hire Purchase & Installment System, Branch & Departmental Accounts - 20 Marks

Topic

- Self-Balancing Ledgers

- Royalties, Hire-Purchase, and Installment System

- Branch and Departmental Accounts

Section D: Accounting in Computerized Environment and Accounting Standards - 15 Marks

Topic

- Overview of Computerized Accounting

- Accounting Standards

Paper 5: BUSINESS LAWS AND ETHICS (BLE)

Section A: Commercial Laws - 30 Marks

Topics

- Introduction to Law and Legal System in India

Indian Contracts Act, 1872

Sale of Goods Act, 1930

Negotiable Instruments Act, 1881

Indian Partnership Act, 1932

Limited Liability Partnership Act, 2008

Section B: Industrial Laws - 25 Marks

Topics

- Factories Act, 1948

- Payment of Gratuity Act, 1972

- Employees Provident Fund and Miscellaneous Provisions Act, 1952

- Employees State Insurance Act, 1948

- Payment of Bonus Act, 1965

- Minimum Wages Act, 1948

- Payment of Wages Act, 1936

- Pension Fund Regulatory and Development Authority Act, 2013

Section C: Corporate Law - 35 Marks

Topic

- Companies Act, 2013

Section D: Business Ethics - 10 Marks

Topic

- Business Ethics and Emotional Intelligence

Paper 7: DIRECT AND INDIRECT TAXATION (DITX)

Section A: Direct Taxation

| Topics | Weightage |

|---|

| Basics of Income Tax Act | 10% | |

| Heads of Income | 25% | |

| Total Income and Tax Liability of Individuals & HUF | 15% |

Section B: Indirect Taxation

| Topics | Weightage |

|---|

| Concept of Indirect Taxes | 5% | |

| Goods and Services Tax (GST) Laws | 35% | |

| Customs Act | 10% |

Paper 8: COST ACCOUNTING (CA)

Section A: Introduction to Cost Accounting - 40 Marks

Topics

Introduction to Cost Accounting

- Cost Ascertainment – Elements of Cost

- Cost Accounting Standards

- Cost Book Keeping

Section B: Methods of Costing - 30 Marks

Topic

- Methods of Costing

Section C: Cost Accounting Techniques- 30 Marks

Topic

- Cost Accounting Techniques

Group - ||

Paper 10: CORPORATE ACCOUNTING AND AUDITING (CAA)

Section A: Corporate Accounting

| Topics |

Weightage |

|---|

| Accounting for Shares and Debentures | 10% | |

| Preparation of the Statement of Profit and Loss and Balance Sheet | 10% | |

| Cash Flow Statement | 10% |

| Accounts of Banking, Electricity, and Insurance Companies | 10% | |

| Accounting Standards | 10% |

Section B: Auditing

| Topics | Weightage |

|---|

| Basic Concepts of Auditing | 10% | |

| Provisions Relating to Audit under Companies Act 2013 | 30% | |

| Auditing of Different Types of Undertakings | 10% |

Paper 9: OPERATIONS MANAGEMENT AND STRATEGIC MANAGEMENT (OMSM)

Section A: Operations Management- 70 Marks

Topics

- Operations Management – Introduction

- Operations Planning

- Designing of Operational Systems and Control

- Production Planning and Control

- Productivity Management and quality management

- Project Management

- Economics of Maintenance and Spares Management

Section B: Strategic Management - 30 Marks

Topics

- Strategic Management Introduction

- Strategic Analysis and Strategic Planning

- Formulation and Implementation of Strategy

Paper 11: FINANCIAL MANAGEMENT AND BUSINESS DATA ANALYTICS (FMDA)

Section A: Financial Management

| Topics | Weightage |

|---|

| Fundamentals of Financial Management | 5% |

| Institutions and Instruments in Financial Markets | 10% |

| Tools for Financial Analyses | 15% |

| Sources of Finance and Cost of Capital | 10% |

| Capital Budgeting | 15% |

| Working Capital Management | 15% |

| Financing Decision of a Firm | 10% |

Section B: Business Data Analytics

| Topics | Weightage |

|---|

| Introduction to Data Science for Business Decision-making | 5% |

| Data Processing, Organisation, Cleaning, and Validation | 5% |

| Data Presentation: Visualisation and Graphical Presentation | 5% |

| Data Analysis and Modelling | 5% |

Paper 12: MANAGEMENT ACCOUNTING (MA)

Section A: Introduction to Management Accounting

| Topics |

Weightage |

|---|

| Introduction to Management Accounting | 5% |

Section B: Activity Based Costing

| Topics | Weightage |

|---|

| Activity Based Costing | 10% |

Section C: Decision Making Tools

| Topics | Weightage |

|---|

| Marginal Costing | |

| Applications of Marginal Costing in Short Term | |

| Decision Making | |

| Transfer Pricing | 30% |

Section D: Standard Costing and Variance Analysis

| Topics | Weightage |

|---|

| Standard Costing and Variance Analysis | 15% |

Section E: Forecasting, Budgeting and Budgetary Control

| Topics | Weightage |

|---|

| Forecasting, Budgeting and Budgetary Control | 15% |

Section F: Divisional Performance Measurement

| Topics | Weightage |

|---|

| Divisional Performance Measurement | 10% |

Section G: Responsibility Accounting

| Topics | Weightage |

|---|

| Responsibility Accounting | 5% |

Section H: Decision Theory

| Topics | Weightage |

|---|

| Decision Theory | 10% |

Master The 12 Skills As A CMA

Accounting

Financial Reporting

Analytics

Performance Management

Cost Management

Technology

Risk Management

Planning

Corporate Finance

Financial Statement Analysis

Forecasting

Budgeting

Career Opportunities After CMA

Finance Manager

Financial Analyst

Cost Accountant

Cost Manager

Chief Financial Officer

Financial Risk Manager

Financial Controller

Contact Us Today for FREE Consultations

Elevate Your CMA Journey with TSD: Where Excellence Meets Guidance.

Why Choose TSD Elevate

Learn from anywhere in the world:

- Uplift your skills and upgrade your Curriculum vitae with a CMA Intermediate Course from TSD Elevate.

- The pandemic has taught us to get digital. So, we have made learning easily accessible with both offline and online classes.

- Grab the opportunity to learn from the comfort of your home with online classes.

- Meet like-minded people and teachers at TSD Elevate with offline classes in Delhi.

- Adjust your batch timing and learn at your own pace.

A phenomenal pass percentage:

- Get the right guidance from the TSD Elevate. All you have to do is join the leading bunch of Certified Management Accountants in Delhi.

- TSD Elevate has been a renowned leader in giving the best CMA courses to its students.

- With an 85% pass percentage, our students consistently raise the bar higher every year.

- Consistent results from all the students after learning from the TSD Elevate CMA course.

Demo Videos

Meet With Our Experienced Faculties

Satyam Mishra Sir

Maths

ICAl Best Faculty Award

Winner

15+ years of experience

Sonika Thareja Ma'am

Economics

19+ years of experience

Jaikab Tyagi

Accounts

8+ years of experience

Sakshi Ma'am

Law & BCR

8+ years of experience

Video Testimonials

Elevate Your CMA Journey with TSD Elevate

TSD Elevate in Delhi excels as the leading institute for CMA coaching, offering comprehensive support across all levels of the course – foundation, Intermediate, and final. Located at Preet Vihar (Delhi), TSD Elevate has a team of exceptionally qualified and experienced faculty members dedicated to delivering superior education. These educators possess deep insights into the latest advancements and study materials in accounting and taxation.